Claudia Sheinbaum Warns U.S. Against Drone Strikes in Mexico, Defends Sovereignty

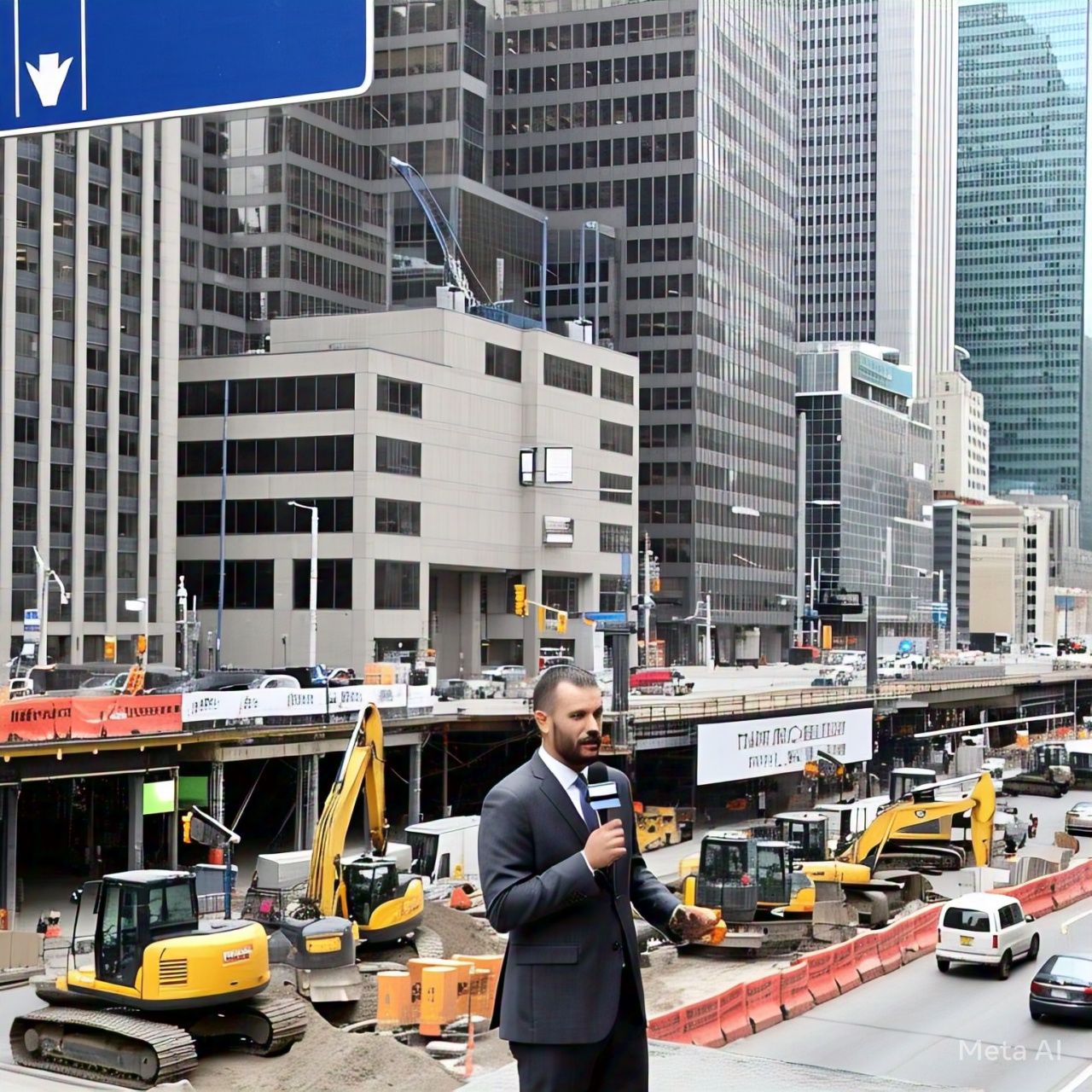

Toronto Targets Construction Contractors to Ease Traffic Gridlock

How Many Coffees Would You Need to Give Up to Afford a Home in Ontario?

Man Critically Injured After Vehicle Drives Off with Gas Nozzle Attached in Etobicoke

Experts Warn Home Insurance Costs Will Increase in 2025 Due to Extreme Weather

Home Insurance Rates Set to Rise in 2025 Due to Extreme Weather, Experts Warn

‘Pure Act of Evil’: Court Hears Disturbing Details of TTC Subway Stabbing

premier-ford-urges-swift-reopening-of-stellantis-plant-in-windsor-amid-tariff-fallout

On the eve of his trial, a Toronto man has pleaded guilty to second-degree murder in the death of his on-and-off-again girlfriend, Brittany Doff, in a downtown courtroom on Thursday.

Kadeem Nedrick, who was originally facing a charge of first-degree murder, admitted to killing 30-year-old Doff in January 2022. His plea came just before jury selection was set to begin.

Doff, a devoted mother to the couple’s four-year-old son, had been trying to leave what friends and family described as a volatile and emotionally turbulent relationship. In the days leading up to her death, she confided in loved ones that she was afraid of Nedrick and wanted him out of her life.

“The relationship was in crisis. She didn’t want him at the home or sleeping over,” said assistant Crown attorney Mary Humphrey, reading from an agreed statement of facts in court.

On January 3, 2022, Doff had been out with a friend before returning to her apartment near College and Clinton Streets. Shortly after arriving, the friend heard a terrified scream from within the unit.

Earlier that day, Doff had left the apartment because Nedrick’s behavior had frightened her. She returned later to collect some belongings and went to the basement bedroom. According to court testimony, Nedrick suddenly appeared and began frantically searching for her, yelling, “Where is she? Where is she?”

He then grabbed several knives and began swinging them, demanding the friend to leave.

Doff was fatally stabbed during the attack.

Sentencing details are expected in the coming weeks. A conviction for second-degree murder carries an automatic life sentence with parole eligibility set by the court between 10 and 25 years.

Toronto Man Pleads Guilty to Second-Degree Murder in Death of Girlfriend

On the eve of his trial, a Toronto man has pleaded guilty to second-degree murder in the death of his on-and-off-again girlfriend, Brittany Doff, in a downtown courtroom on Thursday.

Kadeem Nedrick, who was originally facing a charge of first-degree murder, admitted to killing 30-year-old Doff in January 2022. His plea came just before jury selection was set to begin.

Doff, a devoted mother to the couple’s four-year-old son, had been trying to leave what friends and family described as a volatile and emotionally turbulent relationship. In the days leading up to her death, she confided in loved ones that she was afraid of Nedrick and wanted him out of her life.

“The relationship was in crisis. She didn’t want him at the home or sleeping over,” said assistant Crown attorney Mary Humphrey, reading from an agreed statement of facts in court.

On January 3, 2022, Doff had been out with a friend before returning to her apartment near College and Clinton Streets. Shortly after arriving, the friend heard a terrified scream from within the unit.

Earlier that day, Doff had left the apartment because Nedrick’s behavior had frightened her. She returned later to collect some belongings and went to the basement bedroom. According to court testimony, Nedrick suddenly appeared and began frantically searching for her, yelling, “Where is she? Where is she?”

He then grabbed several knives and began swinging them, demanding the friend to leave.

Doff was fatally stabbed during the attack.

Sentencing details are expected in the coming weeks. A conviction for second-degree murder carries an automatic life sentence with parole eligibility set by the court between 10 and 25 years.